Table of Content

The Canadian government recently announced details about Budget 2022 and the new initiatives to make housing more affordable for Canadians. Manitoba residents who install a new geothermal or solar heating system can receive a Green Energy Equipment Tax Credit. Note that the work must be performed on a property that is your usual place of residence or that of a relative.

Or, a qualifying relation of a senior/disabled person, during which a cost was paid toward an eligible renovation of their primary residence. A senior (age 65+) or disabled person, during which an eligible cost was paid toward a qualifying renovation of your primary residence. Eligible applicants must have been 65 years or older by the end of the tax year of the year in which renovations were completed. Additionally, your home must have been your primary residence at the time of the renovation. However, if you reside with a senior, this requirement is waived if you are in qualifying relation.

Home Renovation Tax Credit [Inactive]

This is fitting since the credit, as its official name suggests, is geared towards seniors. To qualify, you must either be 65 years and up or live with someone who is. Were incurred by the individual filing the return or a qualifying family member.

Home renovation tax credit is intended to help extend the length of time a senior lives in their principal Ontario residence by improving its safety and accessibility. Spending up to $10,000 on eligible expenses like handrails, a walk-in tub, and wheelchair ramps could be worth 25 per cent per year. Homeowners can claim a 10.5 per cent tax credit on up to $20,000 of eligible home renovation expenses which can equal savings of up to $2,100 in provincial income tax.

Canada's Loan Comparison Platform

Before you complete any renovations on your home, make sure you check for any home renovation tax credits offered by the federal or provincial governments. Although renovations can be a huge pain and a serious financial burden, they’re often necessary to improve the living quality of you or someone you care about. Qualified applicants must be 65 years or older by the end of the year for which he/she is claiming the credit. Family members can qualify as well, if they modify their home to accommodate a live-in relative who is 65 or older and can claim eligible expenses on their personal income tax return.

If your home needs additional light fixtures, non-slip flooring, and other modifications designed to improve senior safety, those are covered expenses. This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While the information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.

Home Renovation Tax Credit for Seniors and Persons with Disabilities [Active]

The federal government can give you a rebate on part of your tax if you buy a new home, if you build a new home, or—and this is what we’re interested in—if you do “substantial renovations”. This non-refundable provincial credit was created by Saskatchewan’s Bill 1, The Income Tax Amendment Act, 2020. It’s now administered by the Canada Revenue Agency as part of Saskatchewan’s personal income tax system. This B.C. Home Renovation Tax Credit lets you claim up to 10% of permanent home renovation expenses , to a maximum of $1,000 per year and $10,000 total. Like with the Federal Home Accessibility Tax Credit, you can also claim some renovations as medical costs to get another provincial credit. In places like New Brunswick and British Columbia, you can get a provincial tax credit too.

Tax credits allow you to deduct a specified amount from your taxes due every year. If you do not use the entire credit in a specific year, you can generally carry the unused deductions into future years. Additionally, most programs allow you to share the credit with a partner or spouse.

Views expressed in this article are those of the person being interviewed. They do not necessarily reflect the opinions of National Bank or its subsidiaries. For financial or business advice, please consult your National Bank advisor, financial planner or an industry professional (e.g., accountant, tax specialist or lawyer). The work must help a person to live in their home safely and offer greater autonomy. For example, installing a ramp or stair lift could be considered an eligible expense. If you received any other government assistance, do your calculations carefully.

Home equity loan from Alpine Credits, you’ll be able to cover renovation costs at very reasonable interest rates using the equity you’ve already built up in your home. The money is yours to use how you see fit, with no list of ineligible renovations to worry about. A 15 per cent tax credit on the rest of the capital costs if the installer is certified by the Manitoba Geothermal Energy Alliance, Inc. For years, she held her real estate license in Toronto, Ontario before giving it up to pursue writing within this realm and related niches.

While you may be disappointed to learn that Canada’s home renovation tax credit is no longer available, there’s good news. Some of the country’s most populous provinces have introduced their own renovation tax credits. There are no home renovation tax credits specific to these territories. Making changes to an existing home to provide more living space for an additional family member can cost thousands of dollars, which may be more than a family can afford. For instance, you could take advantage of a portion of the GST/HST new housing rebate program if your renovations meet certain conditions.

In order to participate in the Chauffez Vert program you need to complete and submit your application within six months of having the work completed. While they could also significantly add to the value of your home, the only problem is that most renovations aren’t cheap. In fact, you may have to pay thousands of dollars in basic repairs, labour and materials alone. The calculators and content on this page are provided for general information purposes only. WOWA does not guarantee the accuracy of information shown and is not responsible for any consequences of the use of the calculator.

Renovations that qualify include labour costs, permits, building materials, fixtures and equipment rentals. This tax credit allows homeowners to deduct the cost of renovation projects from their Newfoundland & Labrador income taxes. Locals can receive a rebate of up to $10,000 for changes made to their primary residence. Homeowners must also sign a pre-approval form before starting the project.

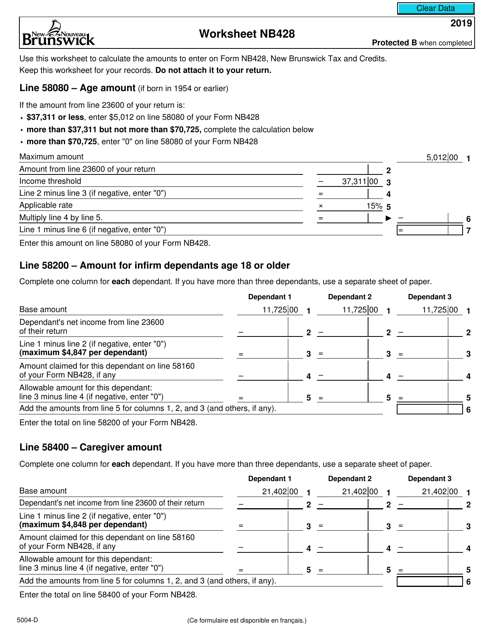

May qualify for this rebate if 90 per cent of the residence is renovated, but talk to your accountant and keep your receipts to be sure. That includes all or the majority of the inside of the building apart from structural components. The amount of the rebate depends on the province and the value of the home. New Brunswickers over the age of 65 can claim deductions on their tax return if they make improvements to their home to make it more accessible.

This translates to a maximum rebate of $6,300 and $9,975 on GST and QST, respectively. To be eligible, you must be 65 years or older or have a disability that prevents you from completing essential daily activities on your own. However, those living with a senior or someone with a disability can claim the deduction on their tax return. Even though you can’t apply for it anymore, it’s good to have some background information for putting those other programs into context. More than one eligible claimant can make a claim, but the total amount claimed cannot be more than $50,000. In addition, only one qualifying renovation can be claimed to accommodate an eligible individual over their lifetime.

No comments:

Post a Comment